Healthcare 360 tries to take a fresh look into health insurance process. It was worked under the guidance of Design Director at Incedo with timely connects with SMEs and other design leads for feedback.

This project is proof of concept that was designed and developed into a MVP (minimum viable product). This helped in gaining quick insights and feedbacks from the C-Level Executives at Incedo Inc and Health Insurance clients.

Context

In today's digitally interconnected world, the traditional model of annual, one-size-fits-all insurance policies is rapidly becoming outdated. The insurance industry faces a critical challenge: adapting to a dynamic environment where risk is no longer static and policyholders expect more personalised, responsive services.

Despite the surge in personal health smart devices, such as fitness trackers, smartwatches, and health monitoring apps, there remains a significant gap in how this real-time data is leveraged. Most health insurance providers continue to rely on outdated models, missing the opportunity to tap into continuous streams of user-generated health data that could reshape how risk is assessed and managed.

Market Analysis

Most existing health insurance applications prioritize claim-related functionalities, offering features such as provider search, claims management, digital ID cards, cost estimation, and payment options.

A few also include advanced services like auto check-in, pharmacy refills, and teleconsultations, though these are not yet widely adopted or seamlessly integrated.

To better understand the gaps and opportunities, we analyzed current platforms across key criteria:

Claim history and stage clarity: Tracking exists, but transparency into claim stages and contextual information is often limited.

Card section: Digital ID cards are available but not always easily accessible.

Robo-chat assistance: Chatbots typically handle basic queries, with limited personalisation or escalation paths.

Virtual services: While some platforms offer Telehealth, integration with user data and history is lacking.

Quick help and access to actions: Frequently-used actions like paying premiums or refilling prescriptions are inconsistently surfaced.

Auto renew/refill (customisation): Automation exists, but often lacks user-defined preferences.

Map view: Provider location maps are available in some apps, but features like proximity filters or live updates are minimal.

Though many apps claim to integrate health and fitness data, usually through in-app HealthKits or BYOD (Bring Your Own Device) options, these data streams remain siloed from claim and care services. As a result, users rarely receive personalized, data-driven nudges that could encourage healthier habits, follow-ups, or preventive care.

This gap reveals a key opportunity to move beyond transactional design and toward platforms that offer continuous, adaptive health engagement.

Opportunity Mapping

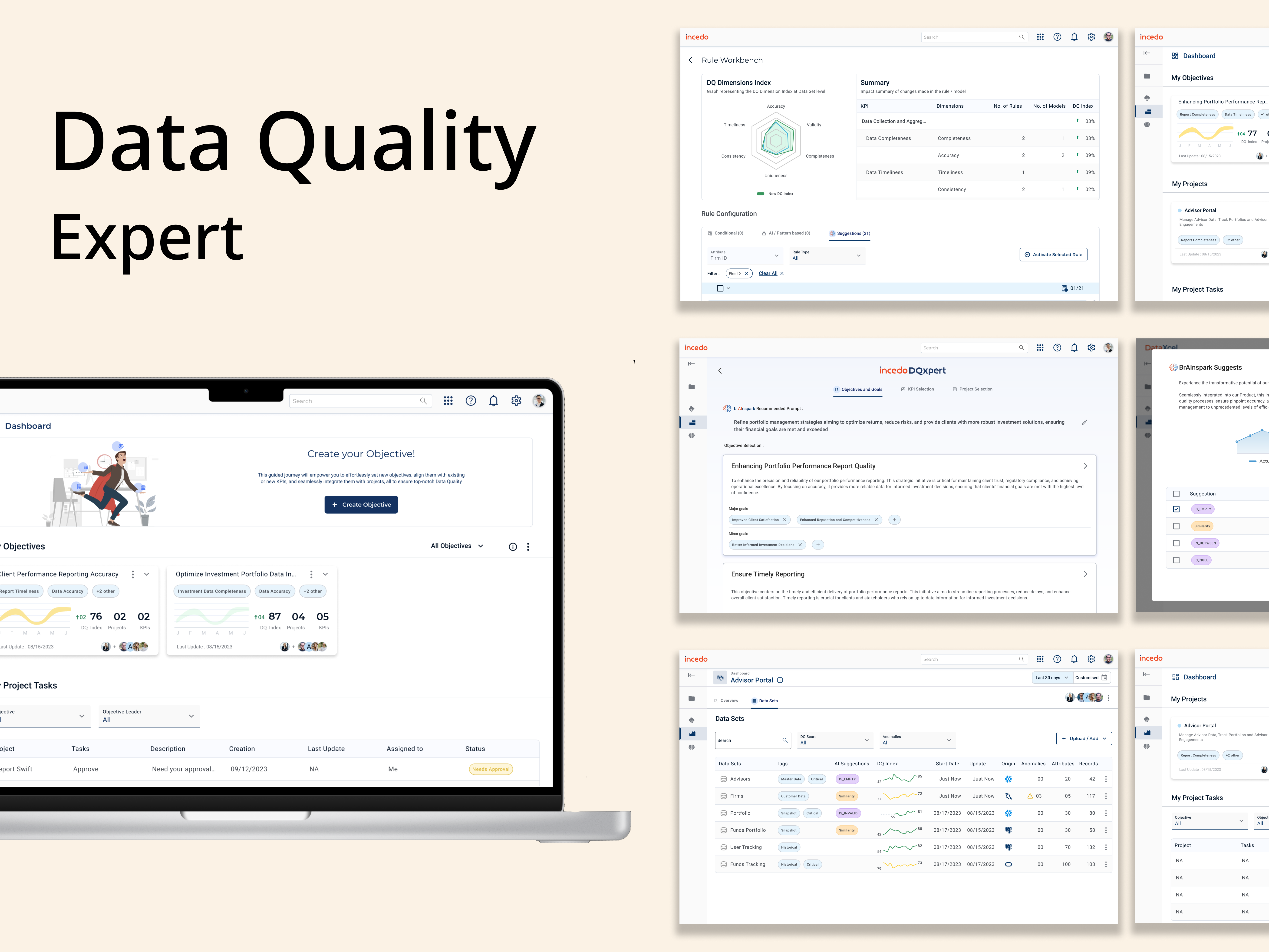

This project explores the transformative potential of integrating real-time data from connected devices with predictive analytics powered by AI and machine learning.

By doing so, insurers can:

1. Offer truly personalised health insurance plans, tailored to individual lifestyles and health patterns

2. Reduce claim processing costs through proactive health management and predictive risk assessment

3. Enhance customer engagement by creating a platform that supports everyday health, not just emergencies

In an evolving technological landscape, embracing adaptive, data-driven insurance solutions is no longer optional—it's essential for staying competitive and relevant.

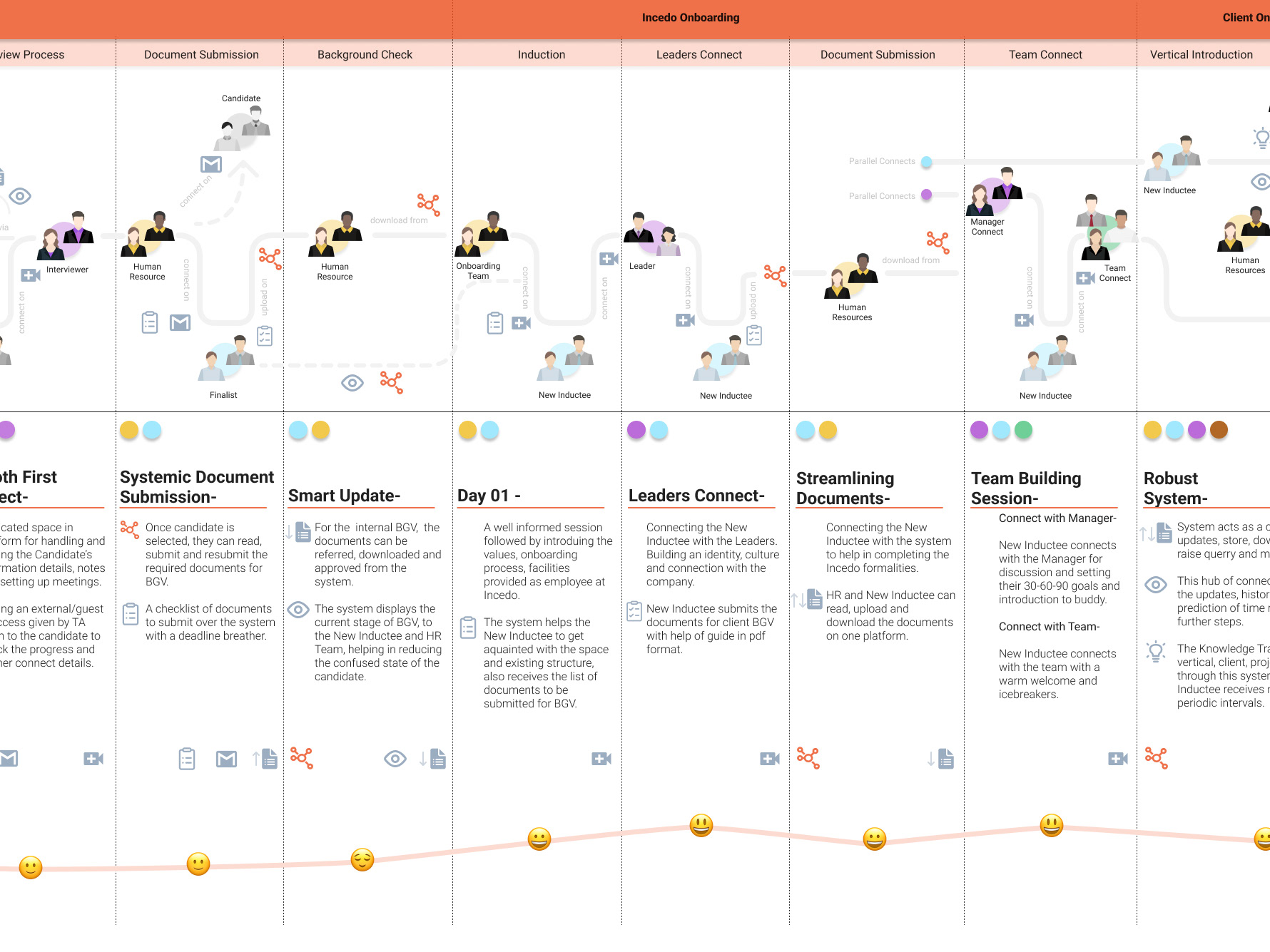

Product Journey

Minimum Viable Product (MVP)

To know more in details about this project feel free to connect with me!